The Mega Backdoor Roth is a powerful strategy for maximizing retirement savings and achieving tax-free growth. This advanced savings method allows high-income earners to bypass traditional Roth IRA income limits and contribute significant sums into a Roth IRA or Roth 401(k). By leveraging after-tax contributions and strategic conversions, individuals can substantially grow their retirement nest egg without the burden of future taxes. Understanding how the Mega Backdoor Roth works, its benefits, and its integration into your retirement plan is essential for effective financial planning.

The Mega Backdoor Roth uses after-tax money from your 401(k) to fund a Roth account. This way, you can save up to $69,000 in 2024. If you're 50 or older, you can save even more, up to $76,500. It's a great way to save for retirement, even if you make too much to qualify for a regular Roth IRA.

The Mega Backdoor Roth strategy involves making after-tax contributions to a 401(k) plan that allows in-service distributions, followed by converting these contributions to a Roth IRA or Roth 401(k). This approach enables individuals to exceed the standard Roth IRA contribution limits and maximize their retirement savings. Unlike the standard backdoor Roth IRA strategy, which involves contributing to a traditional IRA and then converting to a Roth IRA, the Mega Backdoor Roth utilizes employer-sponsored retirement plans, allowing for much larger contributions.

In 2025, the maximum you can save through a mega backdoor Roth will be $70,000 (or $77,500 for those 50 and older). Thanks to changes ushered in by Secure 2.0, people ages 60 to 63 get a supercharged catch-up contribution of up to $11,250, allowing them to save a maximum of $81,250.

The primary difference between the Mega Backdoor Roth and the traditional backdoor Roth strategy lies in the contribution limits and the type of accounts involved. The backdoor Roth IRA is limited by the traditional IRA contribution limit, which is much lower than the potential contributions allowed by a Mega Backdoor Roth strategy. Furthermore, the Mega Backdoor Roth requires a retirement plan that permits after-tax contributions and in-service distributions, making it more suitable for those with access to specific 401(k) plans that support this feature.

Contribution Type | 2025 Limits | Age 50+ |

Roth IRA | $7,000 | $8,000 |

Roth 401(k) | $23,500 | $31,000 |

Maximum After-Tax 401(k) | $70,000 | $77,000 |

Total Possible Contribution (Age 60-63, Super Catch-Up) | – | $81,250 |

Key Differences

Feature | Mega Backdoor Roth | Backdoor Roth |

Contribution Limit | Up to $70,000 (2025) | $7,000 ($8,000 if 50+) |

Involves a 401(k)? | Yes | No |

Conversion Type | After-tax 401(k) to Roth IRA/Roth 401(k) | Traditional IRA to Roth IRA |

Requires Employer Plan? | Yes | No |

Ideal for High Earners? | Yes | Yes |

Complexity Level | High | Moderate |

Potential Tax Impact | Minimal if done correctly | Can be higher depending on pre-tax contributions |

• Higher Contribution Limits: Far exceeds standard Roth IRA limits, allowing for greater tax-free savings.

• Tax-Free Growth: Once converted, investments grow and can be withdrawn tax-free.

• Bypass Income Limits: High earners who exceed Roth IRA contribution limits can still benefit.

• Flexible Withdrawal Rules: No required minimum distributions (RMDs) for Roth IRAs, allowing for greater control over withdrawals.

• Diversified Retirement Strategy: Offers another way to balance pre-tax, Roth, and taxable accounts for tax-efficient retirement income.

• Compounding Growth Advantage: Tax-free earnings accumulation over decades leads to significantly larger retirement savings.

• Protects Against Future Tax Rate Increases: Since Roth distributions are tax-free, investors are shielded from future increases in tax rates.

Employer Plan Requirements

• Must allow after-tax contributions to a 401(k).

• Must permit in-service distributions or conversions to a Roth IRA or Roth 401(k).

• Employer contributions count toward the total 401(k) limit.

• Some plans may impose limits on after-tax contributions, reducing how much can be allocated to the Mega Backdoor Roth.

Contribution Type | Limit (Under 50) | Limit (50+) |

Roth IRA | $7,000 | $8,000 |

Roth 401(k) | $23,500 | $31,000 |

After-Tax 401(k) | $70,000 | $77,000 |

Total (Ages 60-63, Secure 2.0) | – | $81,250 |

• Tax-Free Growth: Once converted, no further taxes apply.

• Tax on Earnings: If the conversion is delayed, investment earnings may be taxed.

• Minimizing Tax Impact: Convert after-tax contributions promptly to avoid taxable growth.

• State Tax Considerations: Some states have different tax treatment for Roth conversions.

• Roth 5-Year Rule: Withdrawals of earnings before five years may incur penalties and taxes unless an exception applies.

• Planning for Tax Burden: Ensure enough liquidity to cover any tax obligations resulting from conversions.

• Long-Term Tax Benefits: Helps create a source of tax-free retirement income, reducing overall tax liability in retirement.

Sarah, a 45-year-old executive earning $300,000 annually, contributes $23,500 to her Roth 401(k) and an additional $46,500 in after-tax contributions to her 401(k). Her plan allows in-service rollovers, so she immediately converts the after-tax amount into a Roth IRA. She avoids taxable earnings and secures tax-free growth.

Mike, 50, contributes after-tax funds but forgets to convert them for two years. In that time, his contributions generate $5,000 in investment gains, which become taxable upon conversion. By delaying, he faces an unnecessary tax burden that could have been avoided with timely action.

David, a self-employed consultant, sets up a solo 401(k) that allows after-tax contributions. He maximizes his contributions and immediately converts them into a Roth IRA, taking advantage of tax-free growth. Because he has full control over his plan, he ensures timely conversions to avoid any tax liability.

1 Confirm Plan Eligibility: Check if your 401(k) allows after-tax contributions and in-service rollovers.

2 Make After-Tax Contributions: Contribute up to the IRS limit.

3 Convert to Roth IRA or Roth 401(k): Move funds before they generate taxable earnings.

4 Repeat Annually: Maintain the strategy for long-term tax-free growth.

5 Monitor Legislative Changes: Stay updated on tax law changes that could affect this strategy.

6 Review Plan Documents: Work with HR or a financial advisor to ensure proper execution.

• Employer Plan Restrictions: Not all plans allow after-tax contributions.

• Complex Tax Reporting: Multiple accounts and conversions require careful tracking.

• Legislative Risks: Future policy changes could impact the strategy.

• Timing of Conversions: Delayed conversions can lead to taxable growth.

• Potential for IRS Scrutiny: The IRS has expressed interest in limiting aggressive use of this strategy.

• Work with HR to understand plan options.

• Consult a tax professional to navigate tax reporting.

• Stay informed on legislative changes affecting Roth conversions.

• Convert after-tax contributions as soon as possible to minimize tax liability.

• Use tax software or a financial advisor to track and document conversions properly.

• Develop a long-term tax strategy that incorporates both Roth and pre-tax accounts for flexibility.

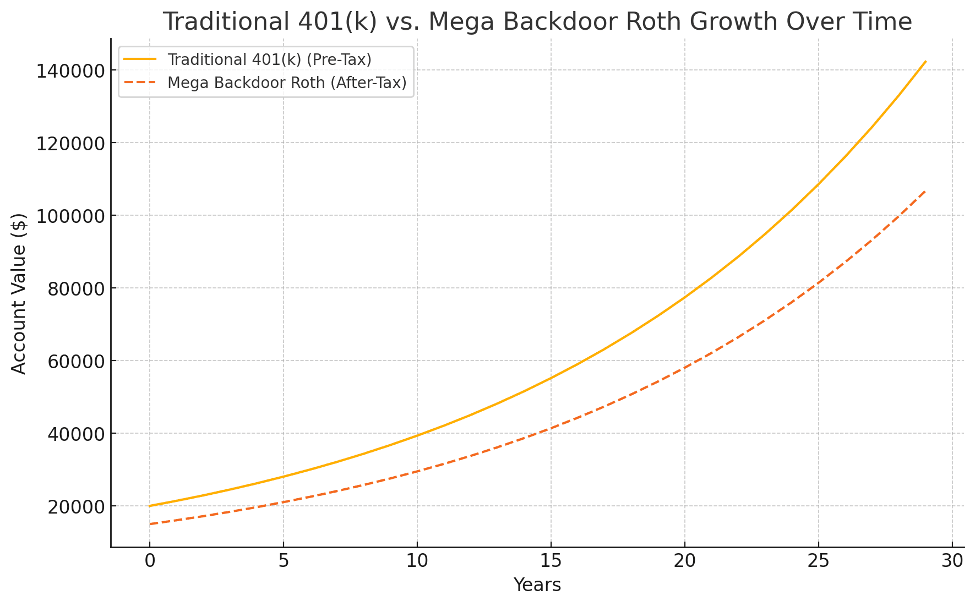

A graphical comparison between pre-tax (Traditional 401(k)) and after-tax (Mega Backdoor Roth) growth over time, showcasing the tax-free compounding advantage of the Roth strategy.

The graph illustrates how tax-free compounding in a Roth account leads to higher overall savings compared to a pre-tax Traditional 401(k), which is subject to taxes upon withdrawal.

The Mega Backdoor Roth is a powerful tool for maximizing tax-free retirement savings. However, it requires careful planning, employer plan compatibility, and tax awareness. Consulting a financial advisor can help determine if this strategy aligns with your financial goals. By leveraging the Mega Backdoor Roth, high-income earners can significantly enhance their tax-free retirement savings while maintaining flexibility in their long-term financial planning. With a disciplined approach, the Mega Backdoor Roth can provide a substantial financial advantage in retirement.